LEARN

Contribute cash or rental real estate, on a tax-deferred basis, using SMI’s 721 exchange program.

Watch this introductory video and get to know the professionals who operate the Fund.

Easier than Owning,

Better than Selling

Keep the benefits of owning rental properties and pass the responsibilities to SMI Legacy Fund. No more day-to-day property management or accounting. You receive the benefits of a more diverse portfolio, managed by real estate professionals, while still deferring capital gains taxes.

Turn Your Portfolio

into Passive Income

Owning multiple rental properties can be a full-time job. By contributing your properties into the Fund by using our 721 Exchange Program, you can spend your days on other pursuits, vacations, or hobbies. The Fund’s professionals have the expertise and economics of scale to bring in your properties, add value, and provide you with true passive income.

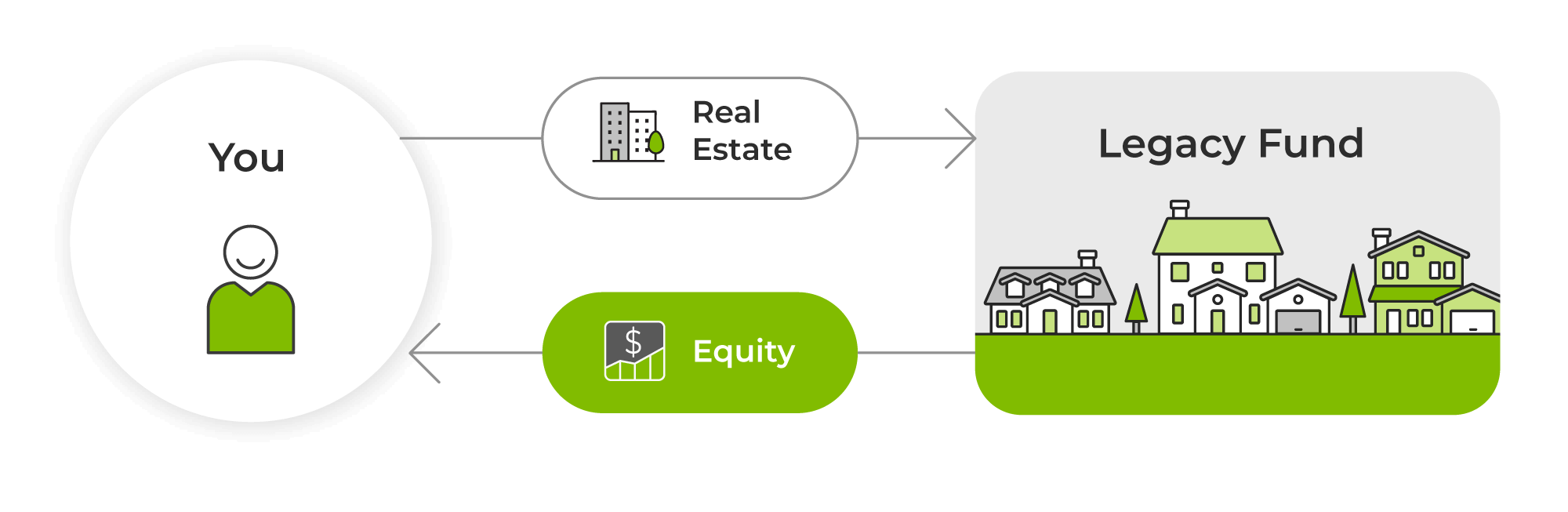

How it Works

The Fund’s 721 Exchange Program uses Section 721 of the Internal Revenue Code. Section 721 allows investors to exchange their Real Estate properties, tax-free, for direct ownership in the Fund. This tax strategy has been utilized by investors since the 1950s. Our management team has a vast amount of expertise and experience utilizing this tax advantaged exchange.

STEP 1

Get a valuation & discuss your needs

Our team will facilitate obtaining a 3rd party MAI Appraisal to determine the value of your real estate. This value is subject to your approval.

Once you receive your appraisal, our experienced advisors can configure the investment into the Fund.

STEP 2

Perform due diligence & sign

the Contribution Agreement

The Fund will share with you the pertinent Investment Documents, including the Fund’s Operating Agreement, Subscription Agreement, Private Placement Memorandum, Contribution Agreement and other Investor Onboarding Documents, for you to review with your legal and tax professionals.

STEP 3

Complete your investment

The Fund will assist you through each step of the closing process. When the investor is ready, the Investment Documents, including transfer deed, will be executed and recorded through escrow, to complete your investment into the Fund.

Once the above is completed, you will be an investor in the SMI Legacy Fund, receiving quarterly distributions and building equity with our partnership.

Frequently Asked Questions (FAQs)

What is the process of investing in the SMI Legacy Fund?

Once I contribute my property to the Fund through the 721 Exchange, will the Fund continue to own and operate my asset on behalf of the Funds investors?

How does the Fund mitigate risk?

Can my accounting, legal, and investment professionals discuss my investment with the Fund’s management?

What fees does the Fund and its manager charge?

Can I “cash-out” a portion of my equity and complete a 721 Exchange for the rest?

Does the Fund accept contributions from investors or invest in properties outside of Oregon?

Connect with Us Today

Learn How Easy It Is To Contribute Your Asset To The SMI Legacy Fund!

Invest Cash or Real Estate Assets.